H&R Block Form 307 2014-2026 free printable template

Show details

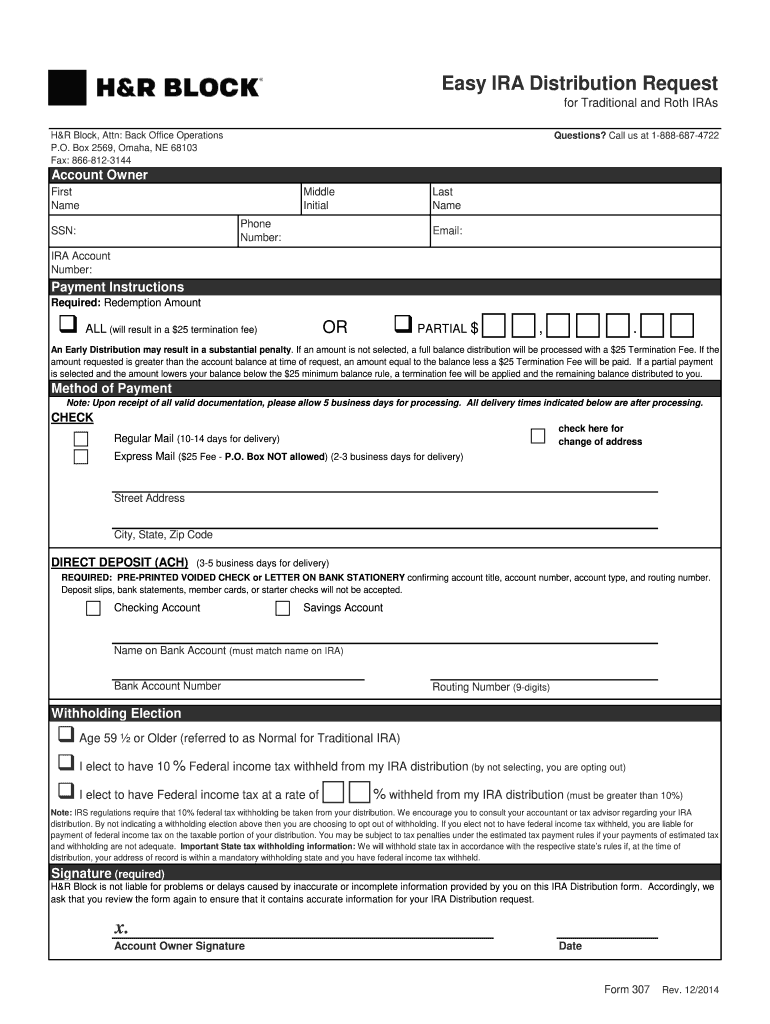

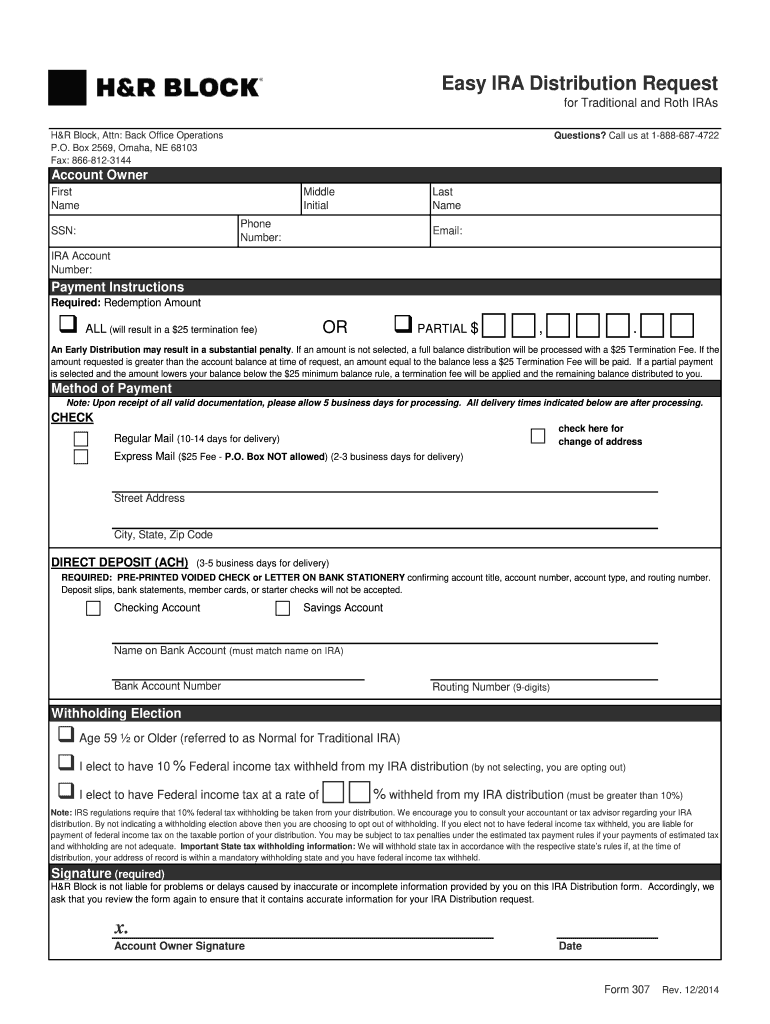

Easy IRA Distribution Request for Traditional and Roth IRAs H&R Block, Attn: Back Office Operations P.O. Box 2569, Omaha, NE 68103 Fax: 866-812-3144 Questions? Call us at 1-888-687-4722 Account Owner

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign h r block form

Edit your h and r block form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your hr block fees form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing h r block advance loan 2026 online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit h r block tax return form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

H&R Block Form 307 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out h r block tax return copy form

How to fill out H&R Block Form 307

01

Gather necessary documents, including W-2 forms and other income statements.

02

Obtain H&R Block Form 307 from the H&R Block website or a local office.

03

Carefully read the instructions provided on the form.

04

Fill in your personal information in the designated sections, including your name, address, and Social Security number.

05

Report your income in the appropriate fields, ensuring accuracy and completeness.

06

Document any deductions or credits for which you are eligible, following the form guidelines.

07

Double-check all entries for accuracy before final submission.

08

Sign and date the form where required.

Who needs H&R Block Form 307?

01

Individuals who are residents of certain states and need to file a state income tax return.

02

Taxpayers seeking to report specific types of income or claim certain credits.

03

Individuals looking for assistance with their state tax obligations who have used H&R Block services.

Fill

can h r block import turbotax files

: Try Risk Free

People Also Ask about h r holiday loan 2025

Do you get a 1099 for IRA contributions?

Retirement accounts, including Traditional, Roth, and SEP IRAs, will receive a Form 1099-R only if a distribution (withdrawal) was made during the year. If you made contributions (deposits) to your IRA account for the tax year, you will receive a Form 5498 detailing those contributions in May.

What is a 5498 form on a 1040?

Form 5498 reports your total annual contributions to an IRA account and identifies the type of retirement account you have, such as a traditional IRA, Roth IRA, SEP IRA or SIMPLE IRA. Form 5498 will also report amounts that you roll over or transfer from other types of retirement accounts into this IRA.

Do I have to report IRA contributions on my tax return?

Contributions to a Roth IRA aren't deductible (and you don't report the contributions on your tax return), but qualified distributions or distributions that are a return of contributions aren't subject to tax.

Do I need to include traditional IRA contributions on my taxes?

Traditional IRA Deductions vary ing to your modified adjusted gross income (MAGI) and whether or not you're covered by a retirement plan at work. If you (and your spouse, if applicable) aren't covered by an employer retirement plan, your traditional IRA contributions are fully tax-deductible.

Do I need form 5498 for my taxes?

Even though Form 5498 reports Roth IRA contribution information, you won't need the form to file taxes unless you're trying to qualify for the Retirement Savings Contributions Credit (Saver's Credit). Only employers can claim a tax deduction for the SEP-IRA and SIMPLE IRA contributions listed on Form 5498.

What happens if I don't report my IRA contributions?

The IRS will charge you a 6% penalty tax on the excess amount for each year in which you don't take action to correct the error. You can be charged the penalty tax on any excess amount for up to six years, beginning with the year when you file the federal income tax return for the year the error occurred.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ira plan income?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific hra 2010e application pdf download and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

Can I sign the hr block w2 electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your hr block business taxes in minutes.

Can I edit hr block cost to file on an Android device?

You can edit, sign, and distribute hr block advance 2026 on your mobile device from anywhere using the pdfFiller mobile app for Android; all you need is an internet connection. Download the app and begin streamlining your document workflow from anywhere.

What is H&R Block Form 307?

H&R Block Form 307 is a tax form used for reporting specific income types and deductions related to taxpayers in the United States.

Who is required to file H&R Block Form 307?

Individuals who have specific income types or deductions that need to be reported, as outlined by the IRS, are required to file H&R Block Form 307.

How to fill out H&R Block Form 307?

To fill out H&R Block Form 307, gather all required documents such as income statements, deduction records, and personal identification information, and follow the instructions provided on the form or the H&R Block website.

What is the purpose of H&R Block Form 307?

The purpose of H&R Block Form 307 is to accurately report specific income and claim related deductions to ensure compliance with tax laws.

What information must be reported on H&R Block Form 307?

Information that must be reported on H&R Block Form 307 includes personal details, income received, allowable deductions, and any other relevant tax-related information as required by the form.

Fill out your HR Block Form 307 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

H R Block Federal Tax Forms is not the form you're looking for?Search for another form here.

Keywords relevant to h r block business 2025

Related to h r block corporate office

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.